Measure 36-236

Sheridan School District Bond

The $6 million school bond measure has passed!

2025 Sheridan Schools Bond Updates

Bond Oversight Committee

The BOC consists of community members, staff and two members of the Sheridan School Board. They receive updates on budget, construction and communications for Bond/OSCIM projects from the Project Manager and District staff, make recommendations to the Superintendent and ensure funds are spent as promised.

Project Timelines

Planning and Permitting kicked-off in Fall of 2025 and is expected to take at least a year, possibly longer for the larger projects. During the initial design phase architects and engineers will work closely with the District and Project Managers to develop specific plans, which will be turned over to officials for approvals and permits.

Construction Updates

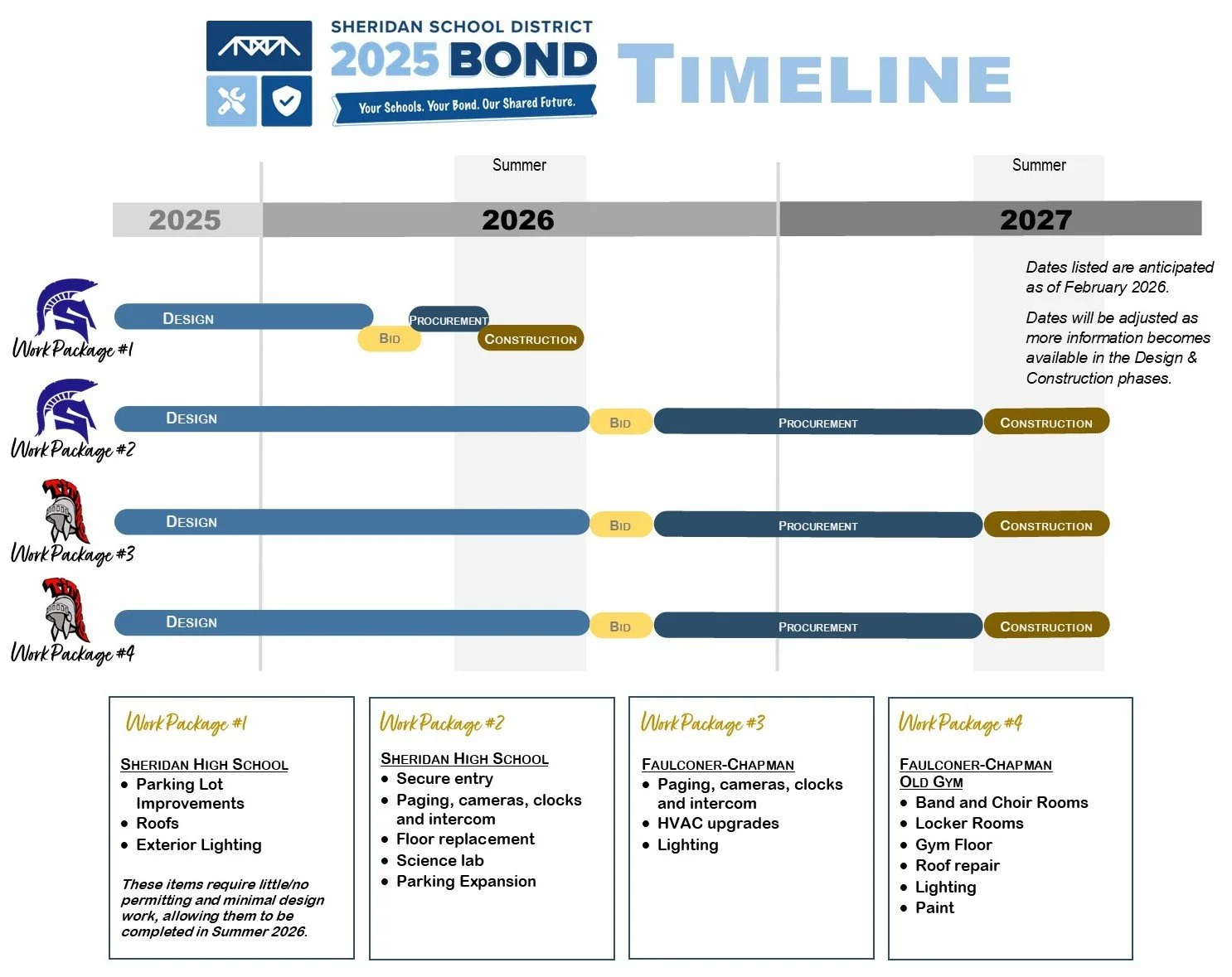

Projects associated with the 2025 Bond have been broken into four separate work packages (see Timeline graphic).

Work Package #1 includes projects that require little-or-no permitting that can be completed in Summer 2026, while #2, 3 & 4 will focus on more complex projects in Summer 2027.

Bond Updates & Progress

-

The Bond Oversight Committee (BOC) convened on February 9 to review an updated scope of work, timelines for 2026 and 2027 summer construction plans and share their feedback. The next meeting will be held on Monday, April 13 at 6:30pm.

Highlights of this meeting are posted here.

More information on BOC meetings can be found here.

-

The Bond Oversight Committee (BOC) convened on December 8 to review adopted budgets, an early program schedule and oversight team responsibilities. The next meeting will be held on Monday, February 9 at 6:30pm.

-

Representatives from BRIC Architecture were on site for the first time on Friday, November 21 to see the spaces that will be impacted by the bond and begin the process of developing more detailed budgets and project timelines.

-

The first meeting of the Bond Oversight Committee took place on Monday, October 13. A recording of the meeting can be viewed here. Upcoming BOC meetings will be posted here.

-

Following a formal RFP process, Sheridan School District and R & C Management Group are pleased to announce that BRIC Architecture has been selected as the Architect/Engineering firm for projects related to the 2025 Bond.

-

Following a considerable amount of summer work by the Sheridan District Business Manager and Superintendent, Sheridan School District received a S&P Global - Rating of an A.

On August 12, this rating resulted in a successful sale of bonds that was 100% subscribed and resulted in a premium just over $280,000. These additional funds will be primarily used to cover fees associated with the bond sale, which would have otherwise come out of the $6 million bond.

-

The Oregon School Capital Improvement Matching (OSCIM - or "Awesome" Grant) Program provides matching grants to districts that pass a local general obligation bond. When voters decided to invest in our local schools, it resulted in a $6,000,000 matching grant from the Oregon Department of Education that doubled the funds available for Sheridan school improvement projects related to the May 2025 Bond.

-

Proposals were received from six different organizations in response to the District’s RFP for a Project Manager. Proposals were scored and three organizations were selected for interviews later in July. Following discussion and reference calls, R&C Management Group, LLC was selected as the Project Manager for the upcoming Bond work.

-

Dear Sheridan Families,

On behalf of our students, staff, and yes, our buildings – THANK YOU for standing behind our community’s children and passing our Sheridan Schools bond.

The message from our community following our previous two bond attempts was clear: narrow the list down to the most critical needs that will allow our schools to continue to function. We listened, did that work, and you were true to your word. We are so grateful you have stayed beside us as we sought a level of funding that worked for our community as well as our schools. While projects not included in this bond will still need to be addressed in the future, this will allow us to make the most essential updates and repairs to the buildings where our children spend hours each day.

We celebrate this moment – and we also know the work has just begun!

The next step in the bond process is the formation of a Community Bond Oversight Committee, which will ensure bond funds are spent appropriately, and as promised. The application for this 5-person committee will be posted to the Sheridan School District website and Facebook in mid-July.

Committee members must live in the boundaries of Sheridan School District and will be joined by representatives from the District, the District Board and the construction contractors to receive updates on budget, projects, communications and other bond related topics. In addition to bond projects, the committee will also have oversight on projects funded by the OSCIM grant and any additional capital improvement grants received by the district during this period.

Applications are due by August 11, and meetings are estimated to begin in Fall 2025.

We are very anxious to begin the work outlined in the bond, and will be working through the process of selling bonds, forming the Oversight Committee and selecting contractors in the coming months. Some smaller projects may be completed during the 2025-26 school year, however large-scale projects will be scheduled to begin in the Summer of 2026, which will allow time for planning and permitting processes to be complete.

We are grateful for your support and look forward to seeing these improvements be implemented over the coming years!

Thank you!

-Dorie Vickery

2025 Sheridan Schools Bond Projects (by School)

Projects at Sheridan High School:

-

Secure entrance (safety)

Replacement of paging, clock and intercom systems (safety)

Security cameras (safety)

Interior flooring replacement (facility repairs & upgrades)

Roof repairs and replacements (facility repairs & upgrades)

Newer gym roof restoration (facility repairs & upgrades)

Interior LED lighting lamps to meet current code (facility repairs & upgrades)

Upgrade interior finishes (facility repairs & upgrades)

Parking lot repavement (facility repairs & upgrades)

Science lab renovations (updated learning & community spaces)

Projects at Faulconer-Chapman:

-

Replacement of paging, clock and intercom systems (safety)

Security cameras (safety)

Intrusion system additions (safety)

HVAC system upgrades (facility repairs & upgrades)

Parking lot lighting (safety)

Interior LED lighting lamps to meet current code (facility repairs & upgrades)

Refinish gym floor (facility repairs & upgrades)

Band and choir room renovations (updated learning & community spaces)

Locker room and restroom renovations (facility repairs & upgrades)

Gym floor and interior renovations (updated learning & community spaces)

Roof restoration (facility repairs & upgrades)

Exterior lighting (safety)

Paint and lighting in older gym (facility repairs & upgrades)